Face Palm Moments – The Friendly House Hunter Tips You Should Avoid

Being a house hunter is a tricky business. You need to be ve…

Being a house hunter is a tricky business. You need to be ve…

Greater Oakland County Home Buyers BUY OR WAIT?... …

Ready for the next power outage with these simple tips. Many…

Many times I meet home buyers that want to buy but due to th…

Greater Oakland County Moving With Children Relocating with…

When it comes time to buy your next home in Oakland County M…

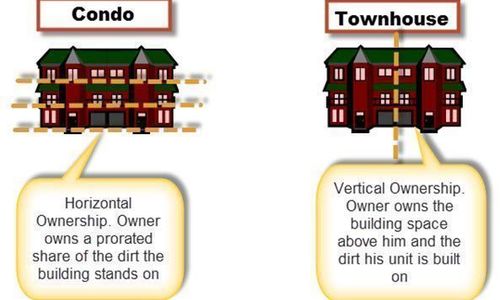

Homeownership can be a great investment that also gives peo…

Home Team-When it's time to buy a home, you'll find it takes…

Negotiating The Best Contract For Your Home Purchase is ve…