ATTOM Data Solutions, Best Days to Sell, Home Preparation, Home Selling Tip, Michigan Real Estate Market, Oakland County Michigan Real Estate, Oakland County Real Estate Market, Property Staging, Real Estate Data Insights

Unlock the Best Days to Sell Your Home in Oakland County, Michigan

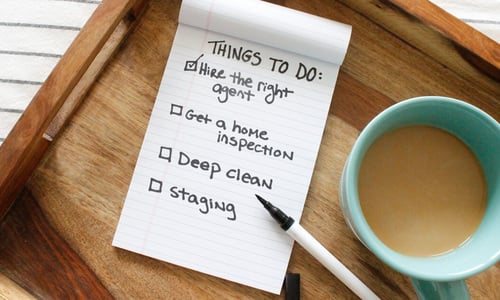

Discover How to Maximize Your Home Sale with Key Dates As a…