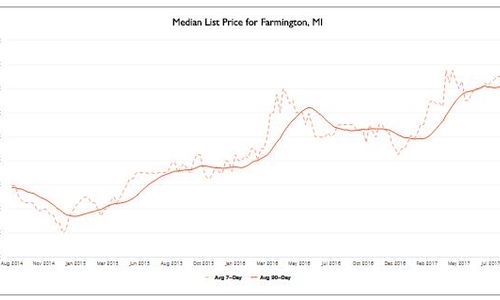

Blog, Farmington Hills Blog, farmington housing market, home buyers, home sellers, low inventories, real estate market

Farmington Hills Michigan Fall Real Estate Market

FARMINGTON HILLS MICHIGAN FALL REAL ESTATE MARKET …

FARMINGTON HILLS MICHIGAN FALL REAL ESTATE MARKET …

Reports That Matter to Home Buyers and Home Sellers These Re…