farmington hills homes, Farmington Hills Housing Market, farmington hills listings, Farmington Hills Real Estate Market, Home Selling Tip, Local Real Estate Insights, sell your home, Selling Your Home in 2025, tips, tips for homeowners

Selling Your Farmington Hills Home in 2025

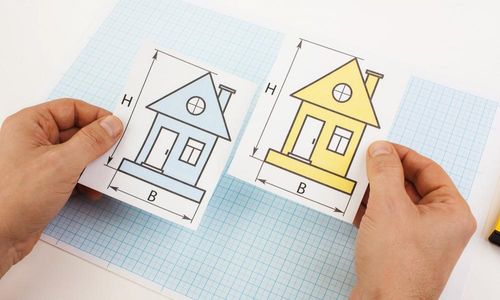

Selling yo…