More than one in eight American homeowners have faced serious mortgage trouble in the past decade, causing stress for families across Oakland County, Michigan. If foreclosure feels inevitable, a deed in lieu offers an alternative path that can protect your financial future and preserve peace of mind. Understanding your options empowers you to make decisions with confidence, backed by professionals who know the unique challenges of the Michigan real estate market.

Pro tip: Maintain meticulous financial records and communicate transparently with your lender throughout the deed in lieu process to improve your chances of successful negotiation.

Pro tip: Maintain meticulous financial records and communicate transparently with your lender throughout the deed in lieu process to improve your chances of successful negotiation.

The main financial and legal effects of a deed in lieu arrangement are summarized below:

The main financial and legal effects of a deed in lieu arrangement are summarized below:

Pro tip: Request a written confirmation from your lender detailing the complete terms of debt forgiveness and potential tax implications before finalizing a deed in lieu agreement.

Pro tip: Consult with a local real estate attorney specializing in Oakland County property transactions to understand the specific implications of each option for your unique financial situation.

Tom Gilliam at Homes2MoveYou.com offers over 20 years of trusted experience helping homeowners and buyers in Farmington Hills, Novi, Troy, and beyond. Whether you are contemplating a deed in lieu, considering your next home purchase, or need skilled negotiation to ease your situation, Tom’s dedicated support and local market knowledge make a difference. Don’t wait until financial pressure rises—explore your options now with a reliable real estate expert who understands your unique needs. Visit Homes2MoveYou.com to get started on a path to stability and confidence today.

Tom Gilliam at Homes2MoveYou.com offers over 20 years of trusted experience helping homeowners and buyers in Farmington Hills, Novi, Troy, and beyond. Whether you are contemplating a deed in lieu, considering your next home purchase, or need skilled negotiation to ease your situation, Tom’s dedicated support and local market knowledge make a difference. Don’t wait until financial pressure rises—explore your options now with a reliable real estate expert who understands your unique needs. Visit Homes2MoveYou.com to get started on a path to stability and confidence today.

Table of Contents

- What Is a Deed in Lieu of Foreclosure

- How the Deed in Lieu Process Works

- Eligibility and Key Requirements in Michigan

- Financial, Legal, and Tax Implications

- Deed in Lieu vs. Short Sale and Foreclosure

Key Takeaways

| Point | Details |

|---|---|

| Deed in Lieu Benefits | Homeowners may avoid the full foreclosure process, reduce long-term credit damage, and in some cases receive relocation assistance by completing a deed in lieu of foreclosure. |

| Eligibility Criteria | Lenders typically require clear title, verified financial hardship, and a property that is well maintained before approving a deed in lieu arrangement. |

| Impact Comparison | A deed in lieu generally results in less immediate credit score damage than foreclosure and provides a faster resolution to mortgage distress. |

| Consultation Importance | Homeowners should consult with experienced real estate professionals and tax advisors to understand legal, financial, and tax implications before proceeding. |

What Is a Deed in Lieu of Foreclosure

A deed in lieu of foreclosure is a strategic financial option for homeowners in Oakland County facing significant mortgage challenges. This legal arrangement allows a homeowner to voluntarily transfer property ownership directly to their mortgage lender, effectively avoiding the more complex and damaging traditional foreclosure process. Homeowners can prevent severe credit damage by proactively negotiating this alternative solution. Under this arrangement, the borrower essentially surrenders the property’s title to the lender, which releases the borrower from personal liability on the defaulted loan. This approach offers several potential benefits for homeowners struggling with mortgage payments:- Reduces the emotional and financial stress of foreclosure proceedings

- Minimizes long-term credit score damage compared to traditional foreclosure

- Potentially helps avoid public record of foreclosure

- May include relocation assistance from the lender

- Provides a faster resolution to mortgage default

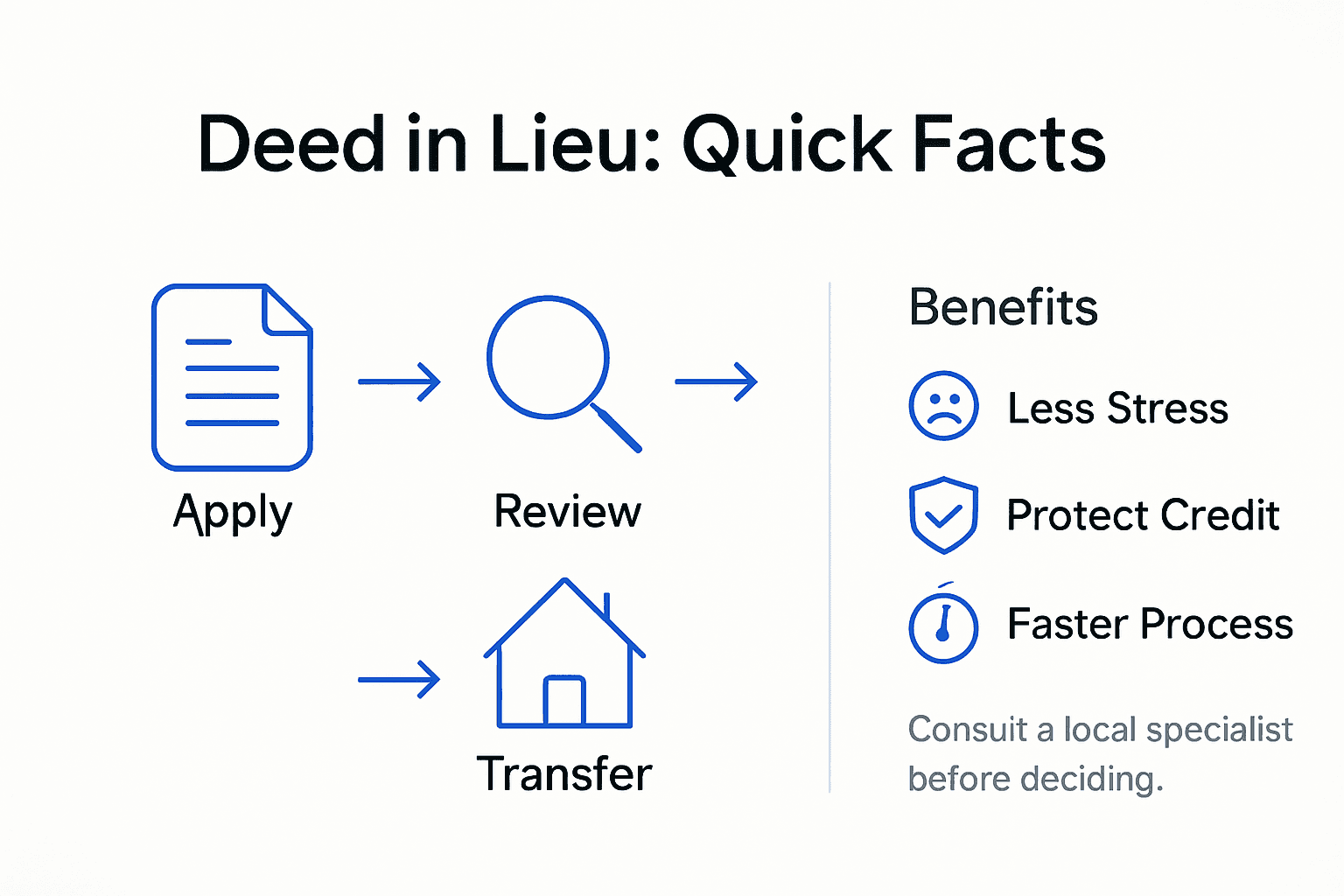

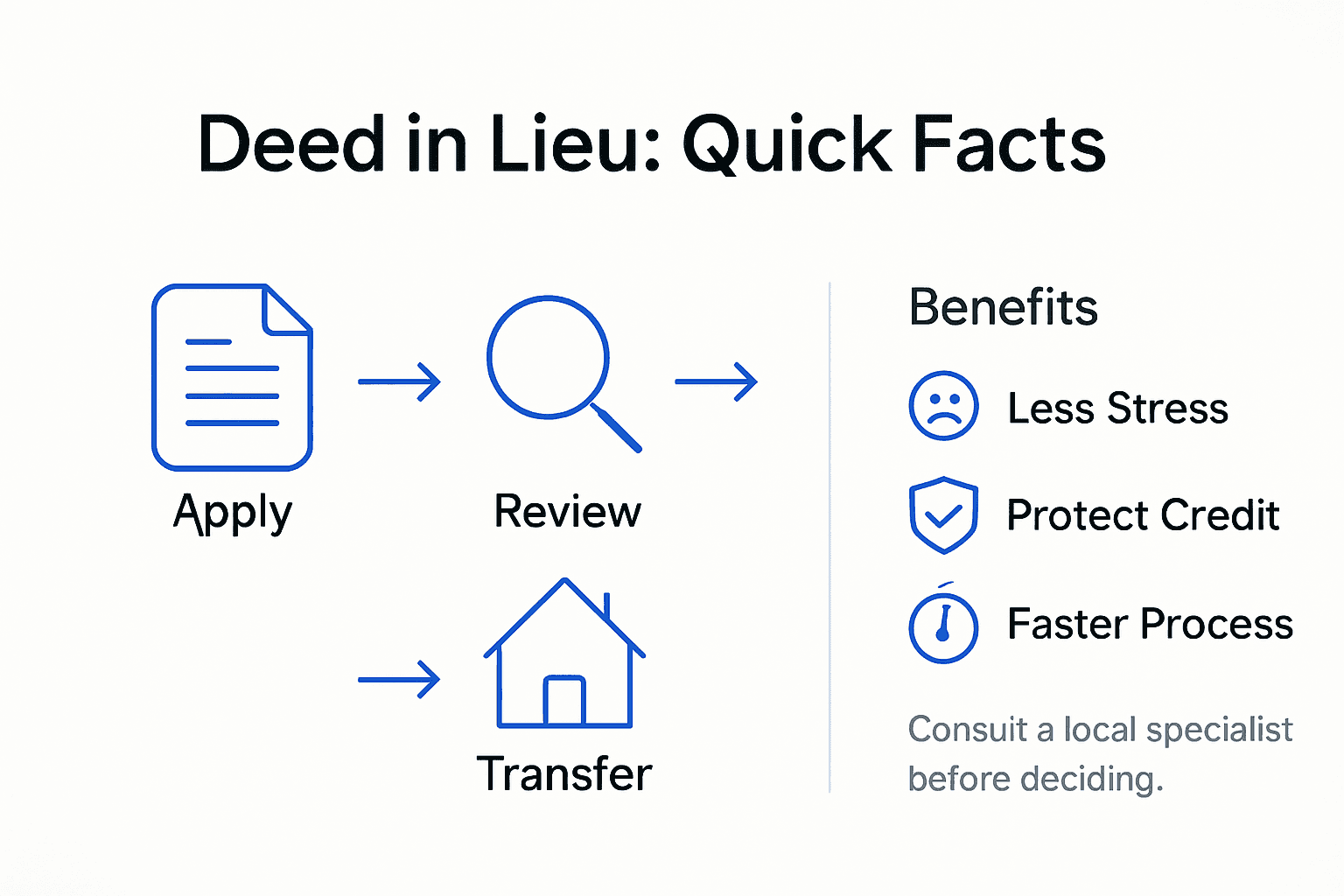

How the Deed in Lieu Process Works

The deed in lieu process is a structured legal pathway for Oakland County homeowners to negotiate property transfer with their mortgage lender. This voluntary agreement involves several critical steps designed to provide a mutually acceptable resolution for both the borrower and the lender. Typically, the process unfolds through a systematic sequence of actions:- Initial Request and Documentation

- Homeowner contacts the mortgage lender

- Submits comprehensive financial documentation

- Prepares a detailed hardship letter explaining financial challenges

- Lender Review and Assessment

- Lender conducts thorough title search

- Orders professional property valuation

- Reviews borrower’s financial hardship evidence

- Determines eligibility for deed in lieu

- Negotiation and Agreement

- Discusses potential terms of property transfer

- Negotiates potential relocation assistance

- Confirms tax and credit implications

- Drafts legal transfer documents

- Final Transfer

- Borrower signs deed transfer documents

- Lender accepts property title

- Legal recording of property transfer

- Mortgage debt is satisfied

Pro tip: Maintain meticulous financial records and communicate transparently with your lender throughout the deed in lieu process to improve your chances of successful negotiation.

Pro tip: Maintain meticulous financial records and communicate transparently with your lender throughout the deed in lieu process to improve your chances of successful negotiation.

Eligibility and Key Requirements in Michigan

For Oakland County homeowners considering a deed in lieu of foreclosure, understanding the specific eligibility criteria is crucial. Lenders carefully evaluate multiple factors before approving this alternative to traditional foreclosure. Michigan homeowners must meet several key requirements to qualify for this option. The primary eligibility requirements include:- Clear Property Title: The property must have no outstanding junior liens or secondary mortgages

- Documented Financial Hardship: Substantial proof of inability to continue mortgage payments

- Good Faith Effort: Demonstrated attempts to resolve mortgage challenges

- Property Condition: Home must be in acceptable condition

- Current Mortgage Status: Typically requires being in default or imminent risk of default

- Detailed income statements

- Bank account records

- Comprehensive expense documentation

- Explanation of financial challenges

- Proof of attempted loan modifications

Financial, Legal, and Tax Implications

Oakland County homeowners considering a deed in lieu of foreclosure must carefully understand the complex financial and legal landscape surrounding this decision. Tax consequences can significantly impact a homeowner’s long-term financial health, making comprehensive analysis critical before proceeding. Financial implications typically involve several key areas:- Credit Score Impact: Less damaging than full foreclosure

- Potential Tax Liability: Forgiven mortgage debt might be considered taxable income

- Potential Debt Forgiveness: Lender may release remaining mortgage balance

- Future Borrowing Restrictions: Temporary limitations on obtaining new mortgages

- Obtaining a clear deficiency waiver

- Ensuring complete release from mortgage obligations

- Verifying proper title transfer

- Preventing potential future legal claims

- Documenting the agreement comprehensively

The main financial and legal effects of a deed in lieu arrangement are summarized below:

The main financial and legal effects of a deed in lieu arrangement are summarized below:

| Impact Area | Short-Term Effect | Long-Term Consideration |

|---|---|---|

| Credit Result | Moderate credit score decline with a faster recovery timeline compared to foreclosure. | Long-term impact is typically less severe than a completed foreclosure when properly documented. |

| Tax Situation | Forgiven mortgage debt may be considered taxable income under certain IRS rules. | Debt cancellation can trigger IRS reporting unless exemptions or relief programs apply. |

| Legal Standing | Often satisfies the mortgage obligation and halts foreclosure proceedings. | Future lender claims are rare when agreements are properly executed and recorded. |

Deed in Lieu vs. Short Sale and Foreclosure

Oakland County homeowners facing mortgage difficulties have multiple options to resolve financial challenges. Understanding the nuanced differences between deed in lieu, short sale, and foreclosure can help make an informed decision that minimizes long-term financial impact. Key differences between these options include: Deed in Lieu- Voluntary property transfer to lender

- Quickest resolution process

- Less credit score damage

- Requires lender approval

- No additional marketing or sale required

- Selling property for less than mortgage balance

- Requires finding a buyer

- More complex negotiations

- Longer processing time

- Potential credit score impact

- Lender-initiated legal process

- Lengthy and public proceedings

- Most significant credit score damage

- Potential legal complications

- Forced property seizure

| Factor | Deed in Lieu | Short Sale | Foreclosure |

|---|---|---|---|

| Ownership Transfer | Property is transferred directly back to the lender. | Property is sold to a third-party buyer with lender approval. | Ownership transfers through lender action or court process. |

| Privacy Level | Generally more private with limited public exposure. | Often listed publicly during the sales process. | Becomes part of public legal records. |

| Required Negotiation | Negotiation occurs between borrower and lender only. | Requires coordination between borrower, lender, and buyer. | Primarily lender-driven with limited borrower input. |

| Typical Resolution Speed | Usually the fastest option when approved. | Moderate timeline; can take several months. | Often lengthy and unpredictable. |

Take Control of Your Oakland County Homeownership Challenges Today

Facing the difficult decision of a deed in lieu of foreclosure can be overwhelming. You may feel uncertain about your options and the best path forward to protect your financial future while navigating complex legal and tax implications. Understanding terms like “deed in lieu” and the importance of clear communication with your lender is crucial. You deserve expert guidance from someone who knows Oakland County real estate inside and out. Tom Gilliam at Homes2MoveYou.com offers over 20 years of trusted experience helping homeowners and buyers in Farmington Hills, Novi, Troy, and beyond. Whether you are contemplating a deed in lieu, considering your next home purchase, or need skilled negotiation to ease your situation, Tom’s dedicated support and local market knowledge make a difference. Don’t wait until financial pressure rises—explore your options now with a reliable real estate expert who understands your unique needs. Visit Homes2MoveYou.com to get started on a path to stability and confidence today.

Tom Gilliam at Homes2MoveYou.com offers over 20 years of trusted experience helping homeowners and buyers in Farmington Hills, Novi, Troy, and beyond. Whether you are contemplating a deed in lieu, considering your next home purchase, or need skilled negotiation to ease your situation, Tom’s dedicated support and local market knowledge make a difference. Don’t wait until financial pressure rises—explore your options now with a reliable real estate expert who understands your unique needs. Visit Homes2MoveYou.com to get started on a path to stability and confidence today.

Frequently Asked Questions

What is a deed in lieu of foreclosure?

A deed in lieu of foreclosure is a legal agreement where a homeowner voluntarily transfers property ownership to their lender to avoid the foreclosure process. This arrangement can minimize credit damage compared to traditional foreclosure.What are the benefits of a deed in lieu for homeowners?

Homeowners can benefit from a deed in lieu by reducing emotional and financial stress, minimizing credit score impact, preventing public foreclosure records, potentially receiving relocation assistance, and achieving a quicker resolution to mortgage default.What are the eligibility requirements for obtaining a deed in lieu?

To qualify for a deed in lieu, homeowners must have a clear property title (no junior liens), demonstrate financial hardship, make good-faith efforts to resolve mortgage issues, and ensure the property is in acceptable condition. Additionally, they typically need to be in default or at imminent risk of default on their mortgage.How does the deed in lieu process work?

The process involves several steps: homeowners must initially contact their lender, submit financial documentation and a hardship letter, undergo lender review, negotiate terms, and then complete the final transfer of property ownership once an agreement is reached.Recommended

- Creative Financing Methods: Expanding Homebuying Options - Homes2MoveYou.com

- Solar Panels in Michigan: Complete Homeowners Guide - Homes2MoveYou.com

- Mortgage Rates Explained: Key Factors Influencing Costs - Homes2MoveYou.com

- What Is Private Mortgage Insurance? Complete Guide - Homes2MoveYou.com

- How to File a Quitclaim Deed in California - Law Office of Eric Ridley