What Is Private Mortgage Insurance? Complete Guide

Over 80 percent of american home buyers put down less than twenty percent on their first mortgage, but many are surprised by the extra cost that comes with this choice. Private Mortgage Insurance, known as PMI, becomes a factor when savings fall short, making homeownership feel a bit more expensive. Knowing how PMI works, why lenders require it, and how it affects monthly payments helps buyers make smarter decisions from the start.

Over 80 percent of american home buyers put down less than twenty percent on their first mortgage, but many are surprised by the extra cost that comes with this choice. Private Mortgage Insurance, known as PMI, becomes a factor when savings fall short, making homeownership feel a bit more expensive. Knowing how PMI works, why lenders require it, and how it affects monthly payments helps buyers make smarter decisions from the start.

Table of Contents

- Defining Private Mortgage Insurance (PMI)

- When PMI Is Required on Home Loans

- How Private Mortgage Insurance Works

- PMI Costs, Payment Methods, and Removal

- Comparing PMI to Other Mortgage Insurance Options

Key Takeaways

| Point | Details |

|---|---|

| Understanding PMI | Private Mortgage Insurance (PMI) is required on conventional loans when buyers put down less than 20%. It protects the lender—not the borrower—against potential default. |

| Cost Factors | PMI rates vary based on credit score, loan size, and mortgage type, typically ranging between 0.58% and 1.86% of the loan amount annually. |

| PMI Removal | Homeowners may request PMI removal once they reach 20% equity, helping reduce monthly payments and long-term costs. |

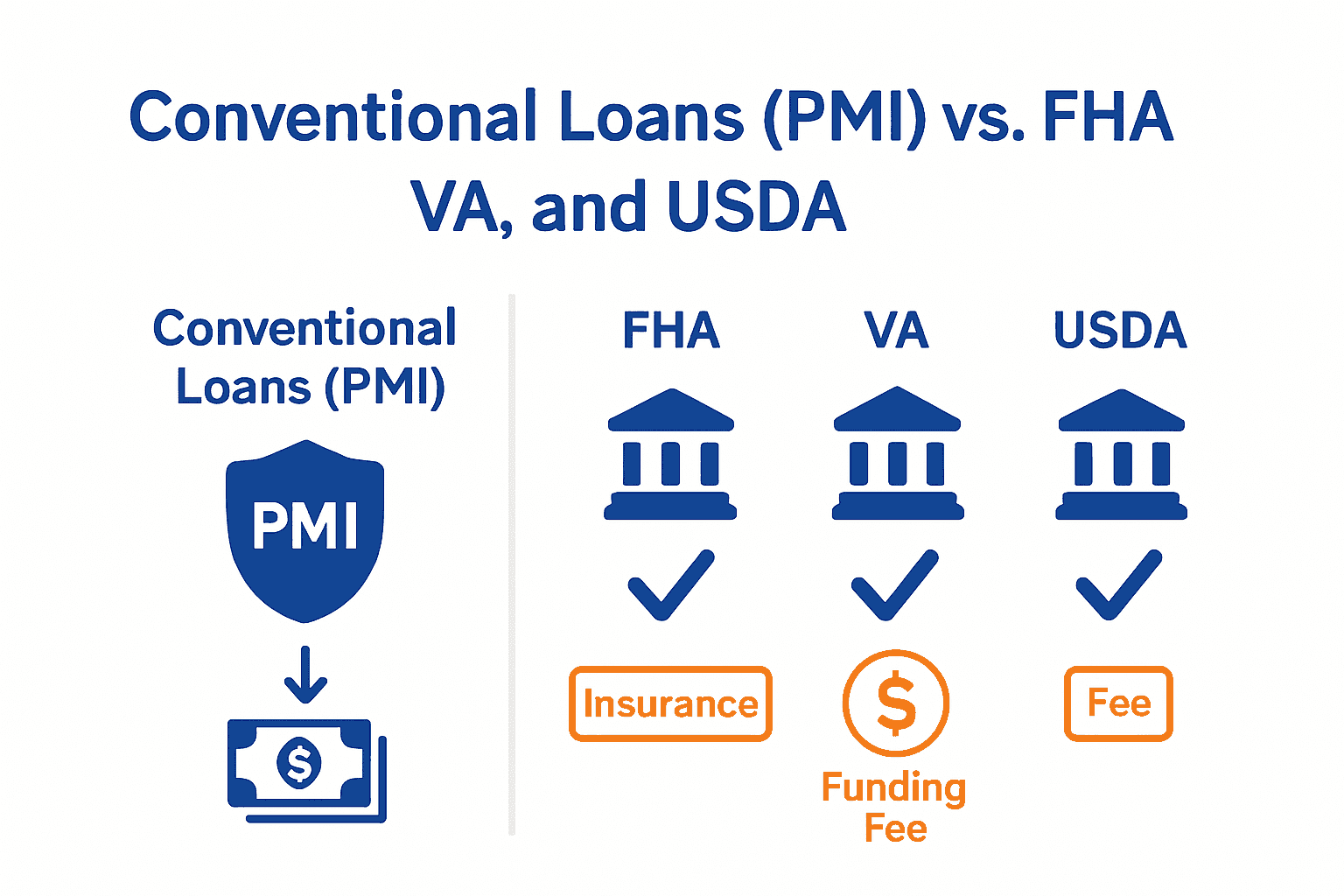

| Comparison with Other Insurance | PMI applies only to conventional loans. FHA, VA, and USDA loans have their own distinct mortgage insurance structures with different rules and requirements. |

Defining Private Mortgage Insurance (PMI)

Private Mortgage Insurance, commonly known as PMI, is a specialized financial protection mechanism that plays a critical role in the home buying process. According to Britannica, PMI is a type of insurance that lenders require from borrowers who make a down payment of less than 20% on a conventional mortgage. Its primary purpose is to protect the lender in case the borrower defaults on the loan. When a home buyer cannot provide a substantial down payment, typically 20% of the home’s purchase price, lenders view the loan as higher risk. Forbes confirms that PMI is typically mandatory when the down payment is less than this threshold. This insurance serves as a safety net for lenders, ensuring they can recover their investment if a borrower stops making mortgage payments. The cost of PMI varies depending on several factors, including:- Your credit score

- The size of your down payment

- The type of mortgage you select

- The loan term

When PMI Is Required on Home Loans

Private Mortgage Insurance (PMI) becomes a necessary requirement for many home buyers based on specific lending criteria. Consumer Finance clearly states that lenders generally require consumers to purchase PMI if their down payment is less than 20 percent of the sales price or the appraised value of the home. This guideline helps lenders manage their financial risk when extending mortgage loans to potential homeowners. According to Chase, the primary trigger for PMI is a down payment below the 20% threshold. This means that borrowers who cannot make a substantial upfront payment will need to budget for this additional insurance cost. Loan types where PMI is most commonly required include:- Conventional home loans

- Fixed-rate mortgages

- Adjustable-rate mortgages (ARMs)

For instance, investment properties, second homes, or loans with higher perceived risk might also mandate PMI. Understanding these nuanced requirements can help potential homeowners prepare financially and develop strategic approaches to minimize or eventually eliminate PMI payments. By planning ahead and improving credit scores, borrowers can potentially reduce their PMI costs or find alternatives that minimize this additional expense.

For instance, investment properties, second homes, or loans with higher perceived risk might also mandate PMI. Understanding these nuanced requirements can help potential homeowners prepare financially and develop strategic approaches to minimize or eventually eliminate PMI payments. By planning ahead and improving credit scores, borrowers can potentially reduce their PMI costs or find alternatives that minimize this additional expense.

How Private Mortgage Insurance Works

Geeks for Geeks explains that Private Mortgage Insurance operates as a financial protection mechanism where the cost is calculated as a percentage of the loan amount and typically paid monthly. PMI is designed to reimburse lenders if a borrower defaults on their mortgage, effectively transferring the risk from the lender to the insurance provider. According to UAM Co, PMI allows borrowers to qualify for larger loans by reducing the lender’s perceived risk. The insurance cost varies based on several key factors:- Down payment size

- Credit score

- Loan type

- Total loan amount

- Property type

PMI Costs, Payment Methods, and Removal

Forbes reveals that PMI costs typically range between 0.58% and 1.86% of the loan amount annually. These costs are directly influenced by critical factors such as loan-to-value ratio, credit score, and the type of mortgage a borrower selects. The actual percentage can significantly impact a homeowner’s monthly mortgage expenses, making it crucial to understand the potential financial implications. According to Consumer Finance, the Homeowners Protection Act provides important protections for borrowers. The act mandates that lenders must automatically terminate PMI when the loan balance reaches 78% of the original home value. Borrowers have additional options for PMI removal, including:- Requesting cancellation at 20% equity

- Making extra principal payments to reach equity faster

- Getting a new home appraisal to demonstrate increased property value

Comparing PMI to Other Mortgage Insurance Options

Britannica clarifies that Private Mortgage Insurance is specifically designed for conventional mortgages, distinguishing it from other mortgage insurance programs. Unlike PMI, government-backed loan programs have unique insurance structures tailored to their specific lending requirements, each with distinct characteristics and coverage approaches. Chase highlights the key differences between mortgage insurance options, which can be compared across several dimensions: Mortgage Insurance Comparison:- Conventional Loans (PMI)

- Applies to loans with less than 20% down payment

- Privately issued by insurance companies

- Cost varies based on credit score and down payment

- FHA Loans

- Government-backed mortgage insurance

- Upfront and annual mortgage insurance premiums

- More flexible credit requirements

- VA Loans

- No traditional mortgage insurance

- Funding fee instead of ongoing insurance

- Available to military service members and veterans

- USDA Loans

- Unique guarantee fee structure

- Lower upfront costs compared to other programs

- Designed for rural and suburban homebuyers

Take Control of Your Home Buying Journey with Expert Guidance on PMI and More

Understanding Private Mortgage Insurance can feel overwhelming especially when you are worried about extra costs and how to build equity faster If you are searching for the right home in Farmington Hills or anywhere in Oakland County knowing how PMI impacts your mortgage payments is crucial to making smart financial decisions. Tom Gilliam at Homes2MoveYou.com offers trusted real estate services that help you navigate these challenges confidently. With over 20 years of experience, Tom knows how to help buyers like you find homes that fit your budget while minimizing unnecessary expenses like prolonged PMI payment. Whether you want expert pricing strategies or skilled negotiation to secure the best deal visit Homes2MoveYou.com to start your personalized home search today and take the first step toward owning your dream home without surprises.

If you are searching for the right home in Farmington Hills or anywhere in Oakland County knowing how PMI impacts your mortgage payments is crucial to making smart financial decisions. Tom Gilliam at Homes2MoveYou.com offers trusted real estate services that help you navigate these challenges confidently. With over 20 years of experience, Tom knows how to help buyers like you find homes that fit your budget while minimizing unnecessary expenses like prolonged PMI payment. Whether you want expert pricing strategies or skilled negotiation to secure the best deal visit Homes2MoveYou.com to start your personalized home search today and take the first step toward owning your dream home without surprises.