Property Taxes Explained: Complete Oakland County Guide

Over 60 percent of american homeowners say property taxes are one of their biggest annual expenses. In Oakland County, understanding how these taxes work can make a real difference for your household budget. With assessments, exemptions, and payment options to navigate, having clear information helps you avoid surprises and gives you confidence about managing this crucial responsibility.

Over 60 percent of american homeowners say property taxes are one of their biggest annual expenses. In Oakland County, understanding how these taxes work can make a real difference for your household budget. With assessments, exemptions, and payment options to navigate, having clear information helps you avoid surprises and gives you confidence about managing this crucial responsibility.

Table of Contents

- Defining Property Taxes In Oakland County

- How Property Tax Assessments Are Conducted

- Millage Rates And Their Local Impact

- Exemptions And Appeals For Homeowners

- Paying, Escrowing, And Managing Tax Obligations

Key Takeaways

| Point | Details |

|---|---|

| Property Taxes Importance | Property taxes fund essential local services and infrastructure, directly influencing community quality, schools, and public resources. |

| Assessment Process Transparency | Homeowners can access detailed online assessment records, promoting clarity and ensuring fair and accurate property tax calculations. |

| Millage Rates Impact | Millage rates determine the amount homeowners pay and support critical services such as education, safety, and municipal operations. |

| Exemptions and Appeals | Eligible homeowners may qualify for exemptions and can appeal assessments if their property value appears inaccurate or unfairly assigned. |

Defining Property Taxes in Oakland County

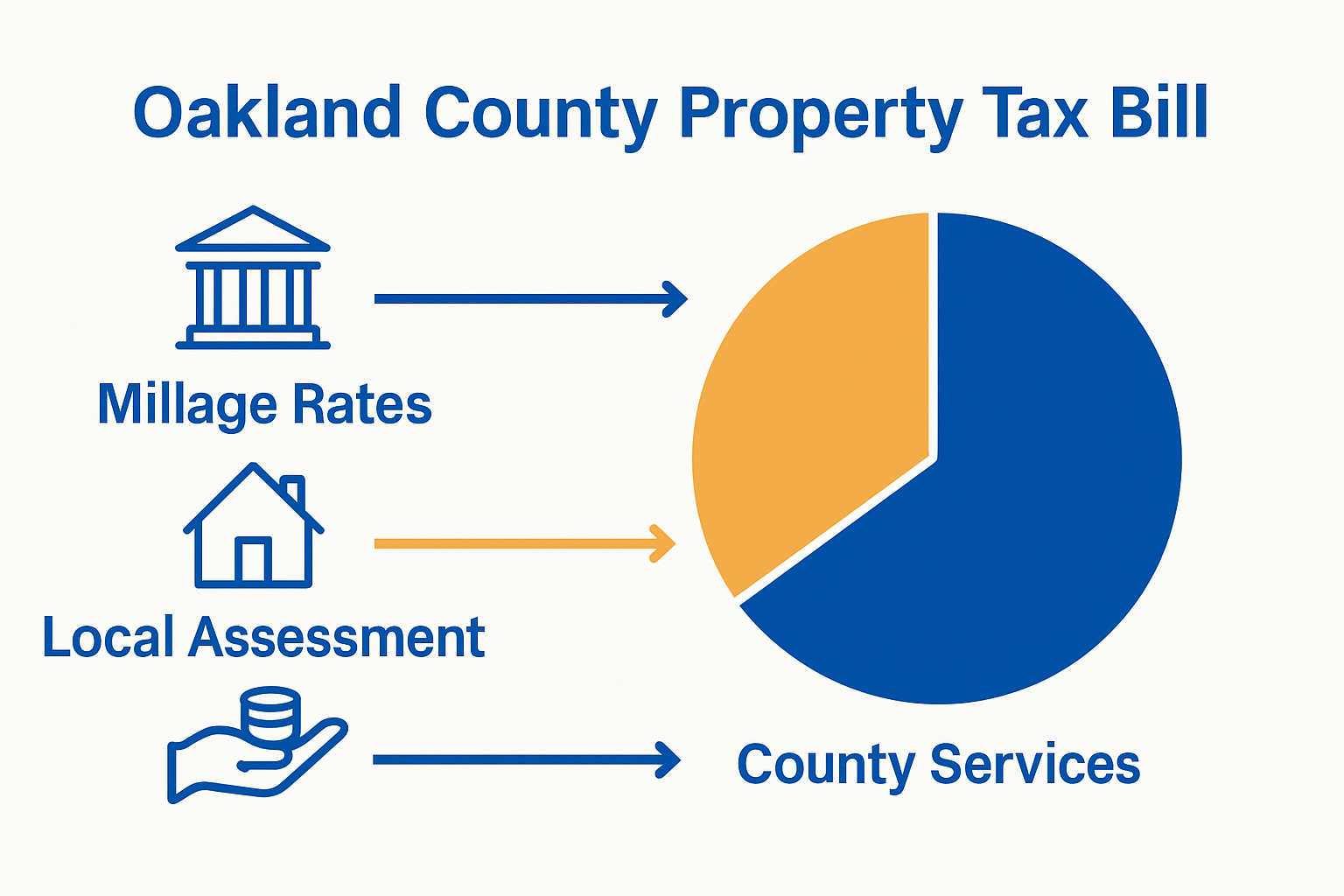

Property taxes in Oakland County represent a critical financial obligation for homeowners, directly supporting local government services and community infrastructure. These annual taxes are calculated based on a property’s assessed value and play a significant role in funding essential municipal resources like schools, public safety, road maintenance, and local government operations. In Oakland County, property taxes are determined through a complex calculation involving several key components. The county assesses property values using standardized methods that consider factors such as location, property size, home improvements, and current real estate market conditions. Homeowners can access detailed property information through the county’s online Property Gateway, which provides transparent insights into how their specific tax amounts are calculated. The tax assessment process in Oakland County follows a structured approach. Local assessors review properties periodically to ensure accurate valuation, typically conducting comprehensive evaluations every few years. Homeowners have the right to appeal their property assessment if they believe the valuation does not accurately reflect their property’s true market value. Mortgage rates can also indirectly influence property tax calculations, as they reflect broader economic conditions that impact real estate valuations.

Understanding property tax components is crucial for Oakland County residents. The total tax bill typically includes millage rates from various local jurisdictions, such as municipal governments, school districts, and county services. These rates are expressed in mills, with one mill representing $1 of tax for every $1,000 of a property’s assessed value. Homeowners can review their specific tax breakdown through online resources, which provide comprehensive details about payment methods, due dates, and potential exemptions or relief programs.

The tax assessment process in Oakland County follows a structured approach. Local assessors review properties periodically to ensure accurate valuation, typically conducting comprehensive evaluations every few years. Homeowners have the right to appeal their property assessment if they believe the valuation does not accurately reflect their property’s true market value. Mortgage rates can also indirectly influence property tax calculations, as they reflect broader economic conditions that impact real estate valuations.

Understanding property tax components is crucial for Oakland County residents. The total tax bill typically includes millage rates from various local jurisdictions, such as municipal governments, school districts, and county services. These rates are expressed in mills, with one mill representing $1 of tax for every $1,000 of a property’s assessed value. Homeowners can review their specific tax breakdown through online resources, which provide comprehensive details about payment methods, due dates, and potential exemptions or relief programs.

How Property Tax Assessments Are Conducted

Property tax assessments in Oakland County are a systematic process designed to determine the fair market value of real estate for taxation purposes. Local government assessors use a comprehensive approach that combines multiple valuation methods to ensure accurate and equitable property evaluations. Property tax profiles provide detailed insights into how these assessments are calculated and applied. The assessment process begins with a thorough examination of several key factors that influence a property’s value. Assessors carefully analyze recent home sales in the neighborhood, current market conditions, property improvements, location characteristics, and the overall condition of the property. Comparative market analysis plays a crucial role, where similar properties in the same area are evaluated to establish a baseline for fair market value. Homeowners can access their detailed property information through the county’s online Property Gateway, which provides transparency in the assessment methodology. Oakland County employs a structured approach to property valuation that occurs on a periodic basis. Most properties undergo a comprehensive reassessment every few years, with annual reviews to capture significant changes that might impact property value. Key factors considered in these assessments include:- Recent home improvements or renovations

- Changes in neighborhood infrastructure

- New construction in the area

- Overall market trends

- Specific property characteristics

Millage Rates and Their Local Impact

Millage rates represent a critical component of property taxation in Oakland County, directly influencing how local government services are funded and maintained. Each mill represents $1 of tax for every $1,000 of a property’s taxable value, creating a complex system that supports essential community infrastructure. Property tax instructions provide detailed insights into how these rates are calculated and applied to individual tax bills. Local jurisdictions in Oakland County levy millage rates from multiple sources, including municipal governments, school districts, community colleges, and special purpose authorities. These rates vary significantly across different communities, reflecting the unique service needs and infrastructure requirements of each area. Taxable value is calculated differently from assessed value, typically representing a lower amount that is used to compute the actual property tax bill. Homeowners can find their specific millage breakdown through current tax profiles, which offer transparency in understanding their tax obligations. The impact of millage rates extends far beyond simple taxation. These rates directly fund critical community services that enhance local quality of life, including:- Public school operations and infrastructure

- Local emergency services (police and fire departments)

- Road maintenance and infrastructure improvements

- Parks and recreational facilities

- Municipal government operations

- Community health and social services

Exemptions and Appeals for Homeowners

Oakland County offers several property tax exemptions designed to provide financial relief for specific homeowner categories. Property tax assistance resources provide comprehensive information about potential tax breaks that can significantly reduce a homeowner’s annual tax burden. These exemptions typically target specific groups, including senior citizens, disabled veterans, surviving spouses of military personnel, and homeowners experiencing economic hardship. The primary exemptions available in Oakland County include the Homestead Property Tax Exemption, which reduces the taxable value for primary residences. Eligible homeowners can claim exemptions that potentially lower their property tax obligations by reducing the property’s taxable value. Property Gateway offers detailed information about qualifying criteria and application processes for these tax relief programs. Key exemption categories typically encompass:- Disabled veterans

- Senior citizens over 65

- Surviving military spouse exemptions

- Disability-related property tax reductions

- Principal residence exemptions

- Agricultural property tax considerations

Paying, Escrowing, and Managing Tax Obligations

Property tax payments in Oakland County require strategic planning and understanding of multiple payment options. Property tax payment instructions outline comprehensive methods for homeowners to meet their tax obligations efficiently and avoid potential penalties. Timely payments are crucial to maintaining good standing with local tax authorities and preventing potential liens or foreclosure risks. Homeowners have several payment strategies available, with mortgage escrow being one of the most common approaches. Through escrow, homeowners include property tax payments as part of their monthly mortgage installment, allowing the mortgage servicer to hold and distribute funds when taxes become due. This method provides several advantages:- Automatic tax payment tracking

- Elimination of large lump-sum tax bills

- Reduced risk of missed payments

- Simplified financial management

- Typical tax billing cycles (summer and winter)

- Accepted payment methods (credit/debit cards, electronic transfers, checks)

- Potential convenience fees for certain payment methods

- Grace periods and late payment penalties

Take Control of Your Oakland County Property Taxes with Expert Local Guidance

Navigating the complexities of property tax assessments and millage rates in Oakland County can feel overwhelming. Whether you are buying your first home or selling a property, understanding exemptions, appeals, and tax obligations is essential to protect your investment and financial future. Many homeowners struggle with deciphering assessment values or finding the right strategies to manage their tax burden. Tom Gilliam at Homes2MoveYou.com understands these challenges and offers trusted, clear guidance to help you make confident real estate decisions in Farmington Hills and across Oakland County. Explore how professional expertise in local market conditions, tax implications, and negotiation can save you money and stress. Visit Homes2MoveYou.com today for tailored support that goes beyond listings. Discover practical insights and personalized strategies by connecting with Tom Gilliam, a top-ranked Farmington Hills real estate agent. Don’t wait until tax season to understand your obligations. Take the first step now toward a smoother property journey with trusted help at Homes2MoveYou.com and unlock your full potential in navigating Oakland County real estate.

Explore how professional expertise in local market conditions, tax implications, and negotiation can save you money and stress. Visit Homes2MoveYou.com today for tailored support that goes beyond listings. Discover practical insights and personalized strategies by connecting with Tom Gilliam, a top-ranked Farmington Hills real estate agent. Don’t wait until tax season to understand your obligations. Take the first step now toward a smoother property journey with trusted help at Homes2MoveYou.com and unlock your full potential in navigating Oakland County real estate.