If you have ever desired to own a place or sell off your existing one for an upgrade, you surely know how it feels when housing prices change. It is a story of financial targets, uncertainties, and slight jitters that many can relate to.

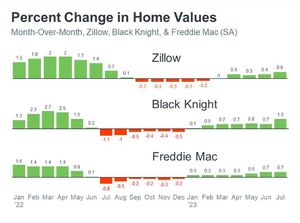

It’s good to note that the market is not dropping due to fear of falling home prices. On the contrary, it is going up. This year’s national data from multiple sources has continuously shown rising home prices (see graph below):

The graph shows a steep increase in house prices during the first half of 2022, as depicted by big green bars on the left. However, these spirals were considered extreme and unsustainable. Consequently, there was some correction in pricing during H2 of 2022, with red showing a slight decrease in price levels despite these little and short-lived drops in purchase prices, which caused panic among buyers’ minds when the media reported them.

What has not been revealed fully are positive trends concerning next year’s property market. Prices are again on their way up but at a more ordinary pace this time, as indicated by respective green bars at the right end of the chart. This normalizing return after high price gains and corrections seen last year will give people peace.

Orphe Divounguy, Senior Economist at Zillow, says:

“The U.S. housing market has surged over the past year after a temporary hiccup from July 2022-January 2023. . . . That downturn has proven to be short-lived as housing has rebounded impressively so far in 2023. . .”

Looking ahead, home price appreciation typically starts to ease up this time of year. As that happens, there’s some risk the media will confuse slowing price growth (deceleration of appreciation) with home prices falling (depreciation). Don’t be fooled. Slower price growth is still growth.

Why Are Home Prices Increasing Now?

Home prices are going back up because there still aren’t enough homes for sale for all the people who want to buy them.

Even though higher mortgage rates cause buyer demand to moderate, they also cause the supply of available homes to decrease. That’s because of the mortgage rate lock-in effect. When rates rise, some homeowners are reluctant to sell and lose their current low mortgage rate to take on a higher one for their next home.

So, with higher mortgage rates impacting both buyers and sellers, the supply and demand equation of the housing market has been affected. But since more people still want to purchase homes than there are homes available to buy, prices continue to rise.

As Freddie Mac states:

“While rising interest rates have reduced affordability and demand, they have also reduced supply through the mortgage rate lock-in effect. Overall, the reduction in supply has outweighed the decrease in demand. Thus, house prices have started to increase . . .”

Here’s How This Impacts You

Looking ahead, we see that home price appreciation tends to slow down at this time of year. There is a danger that media mix a slower growth rate with declining home values. Just remember that even lower price growth still means growth.

Home values have started surging again because of the lack of supply relative to demand for houses available for sale. They could even lead to a reduced sale of home supplies due to the mortgage rate lock-in effect. When rates go up, owners do not want to sell with their current low mortgage rate and lose it. This imbalance between supply and demand keeps pushing prices higher.

According to the data, buyers afraid of downtrends should know that home prices are growing. If there is any worry about changing housing prices from among vendors, then going by what recent statistics indicate, they should consider involving a realtor as their sentiment may have changed.

A Nationwide Surge in House Prices

If you haven’t moved yet because you’re scared of home values dropping, this information shows that house prices are rising across America. It is thus advisable to link up with professionals like Homes 2 Move. We will provide insight into changes in home costs within your local area.