Before you decide to sell your house, knowing the housing market’s current state is essential. One positive trend is that homebuyers adapt and accept today’s mortgage rates as a new standard.

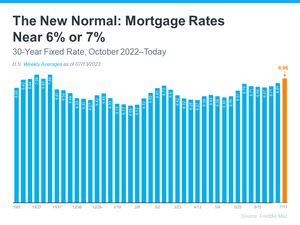

The graph below gives a better understanding of what happened with mortgage rates recently. It illustrates the trend for 30-year fixed mortgage rates from Freddie Mac since last October. In the past nine months, rates have consistently been between 6% and 7%.

According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), this means that (2) “The impact of mortgage rates on buyer demand and therefore how fast homes will sell.” He emphasizes the positive effects brought by steady rates:

“Mortgage rates heavily influence the direction of home sales. Relatively steady rates have led to several consecutive months of consistent home sales.”

For sellers who are reading this now, it should be noted that there is some good news regarding home sales: they have been stable lately. This suggests that buyers remain pretty active in the marketplace, and they are purchasing houses. Here’s more about how recent mortgage rate changes affected demand.

When we saw mortgage interest soar last year, going from around 3% to 7%, many potential buyers became unsure about their plans to buy a house due to an abrupt increase. As time has passed, he noted that people have increasingly acclimated to these numbers rather than being taken aback by them. Buyers who were initially more accustomed to lower prices viewed them as an extraordinary occurrence. They explored alternative options after weighing factors such as improved employment opportunities or lower borrowing costs elsewhere, ensuring they don’t miss out on potentially lucrative opportunities. In the words of Doug Duncan:

“. . . consumers are adapting to the idea that higher mortgage rates will likely stick around for the foreseeable future.”

In fact, according to a recent Freddie Mac survey, nearly one out of every five people surveyed intends to make a home purchase shortly. In other words, this means that 18% of those surveyed are likely to buy homes within six months, showing proactive buyers’ mindsets.

However, it is essential to note that mortgage rates are not the sole determinant of buyer demand. Regardless of mortgage rate fluctuations, people will always have reasons to move. Be it for job relocation, changes in household size, or their own needs. It also signifies that as a seller, you can rest assured about a market for your house today. Its demand remains robust even as buyers adjust themselves according to current rates.

How Buyers Adapt to the New Normal in Mortgage Rates

Buyers perceive today’s mortgage rates differently as they get used to the new normal. Consistency in these rates contributes to high buyer demand and continued selling of homes. Let us know how we can help you with your listing needs so that we can prepare it for an offer from one of these motivated shoppers.