Metro Detroit’s Game-Changer: The $800M “MI Home” Plan Tackles the Affordable Housing Crunch

Michigan’s $800M MI Home Program aims to add 10,000 affordable homes in Metro Detroit with grants, loans, zoning reforms, and employer-assisted housing solutions.

Introduction: A Market in Transition

The Metro Detroit housing market is at a critical turning point. Families in Farmington Hills, Novi, Troy, and Detroit face limited inventory, bidding wars, and rising costs. Teachers, nurses, first responders, and trade professionals—people who keep our communities running—are struggling to find affordable housing within reach of their jobs.

Michigan leaders are responding with the $800 million MI Home Program, a bold plan to create or rehabilitate 10,000 affordable homes over five years. With a mix of grants, housing loans, zoning incentives, and workforce housing partnerships, the initiative targets the shortage of nearly 119,000 housing units statewide.

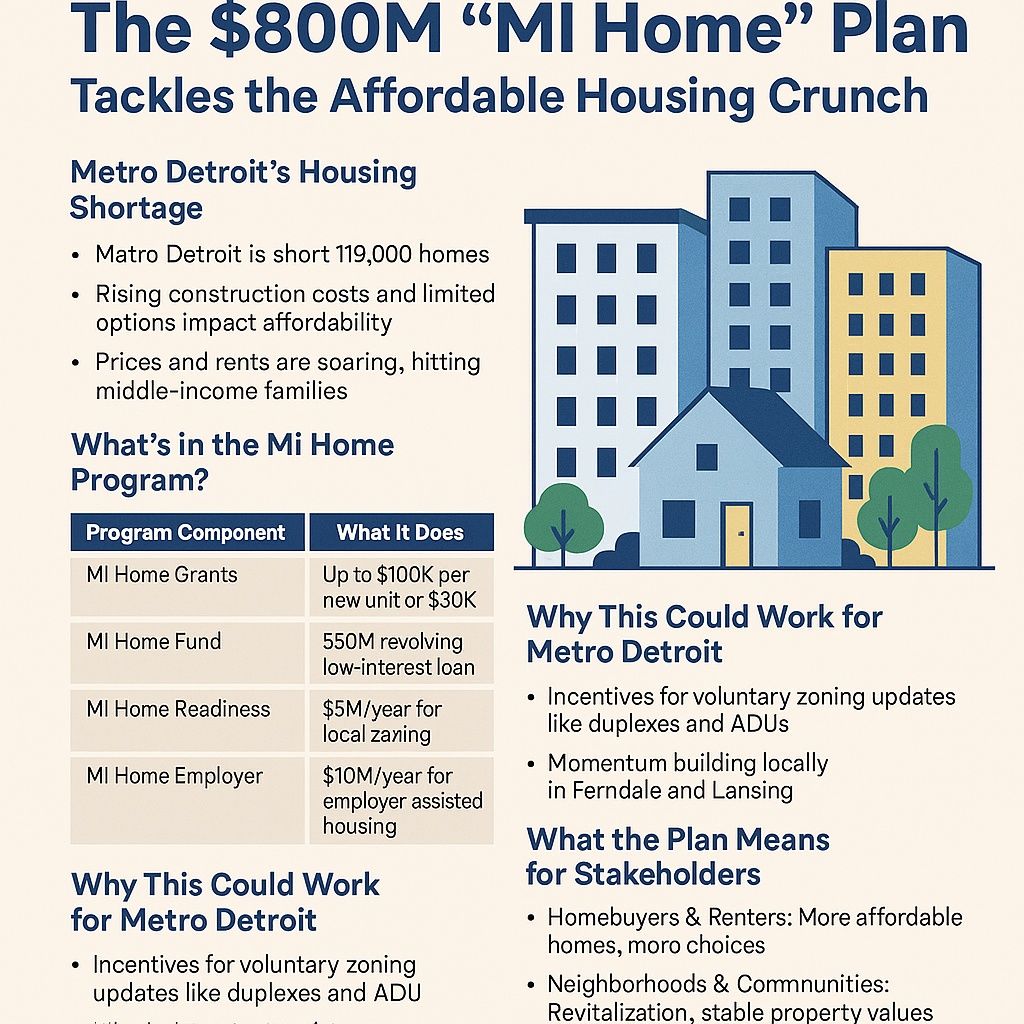

Metro Detroit’s Affordable Housing Shortage

Data from the Michigan State Housing Development Authority (MSHDA) highlights the scale of the problem:

- Michigan is short 119,000 homes as of 2025.

- Construction costs have climbed 38% since 2019 (National Association of Home Builders).

- Average home prices in Farmington Hills have risen to $375,000; in Novi, they now exceed $450,000.

- Rents in Metro Detroit have surged 25% in five years, squeezing middle-class families.

“We are seeing families making six figures who still can’t comfortably afford homes in Oakland County,” says Dr. Karen Smith, a housing economist at Wayne State University. “Without intervention, we risk losing talent to states with more affordable housing markets.”

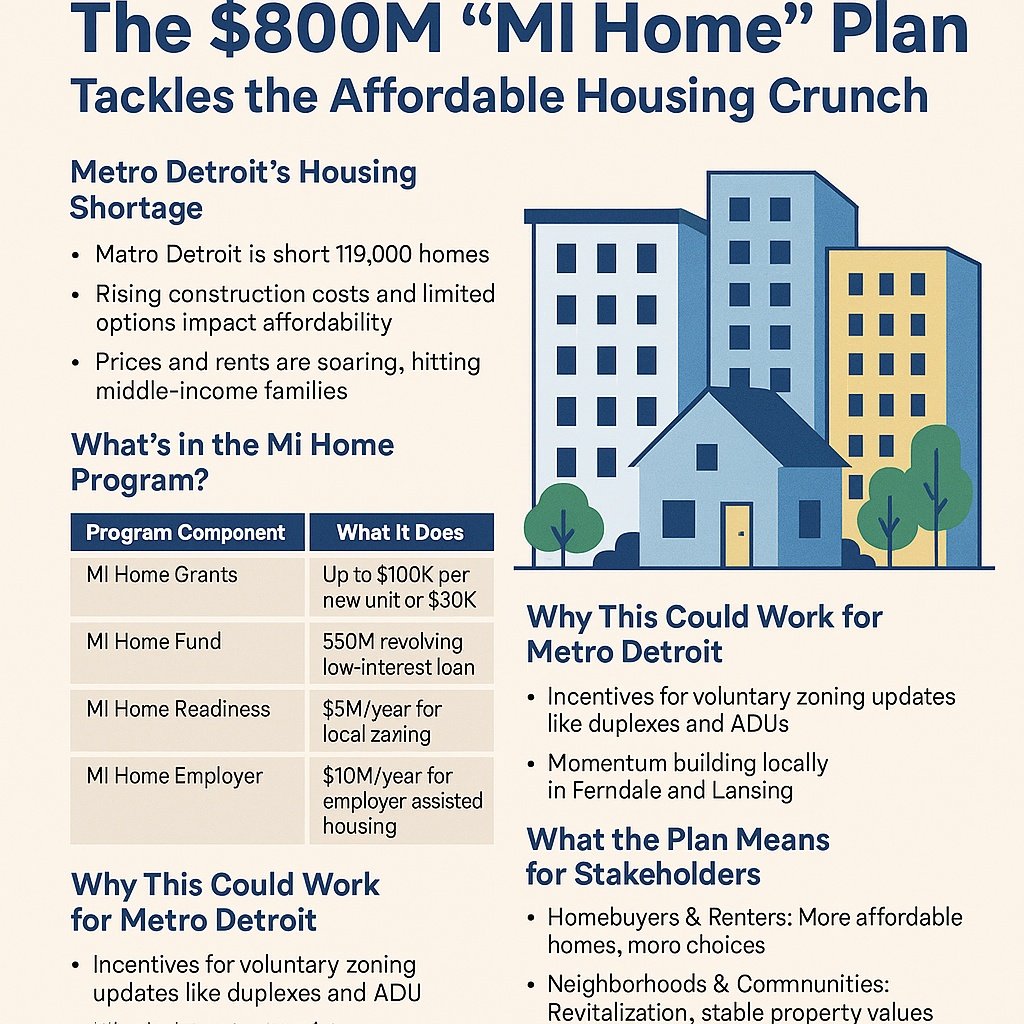

Michigan Housing Incentives: What Is the MI Home Program?

The MI Home Program is structured to address multiple housing challenges at once. Here’s a breakdown of its components:

| Program Component | What It Does |

|---|---|

| MI Home Grants | Provides up to $100K per new housing unit or $30K per rehab project, covering about 30% of construction costs. These housing grants and loans in Michigan help bridge affordability gaps. |

| MI Home Fund | Offers a $50M revolving low-interest loan pool to support developers and municipalities building or rehabbing housing. |

| MI Home Readiness | Allocates $5M annually to fund zoning reform in Michigan, with grants of up to $50K for local planning projects that modernize housing policies. |

| MI Home Employer | Provides $10M per year to encourage workforce housing in Michigan through employer-assisted housing initiatives. |

All homes funded must remain affordable for at least 10 years, capped at 120% of Area Median Income (AMI). This ensures homes are accessible to middle-income families, not just low-income households.

Why This Matters for Metro Detroit

1. Incentives Instead of Mandates

Rather than imposing statewide zoning laws, the MI Home Program rewards cities that modernize their housing codes. Communities that legalize duplexes, ADUs, and smaller lots qualify for significant funding—creating positive momentum for housing diversity.

2. Early Adopters Leading the Way

Ferndale abolished single-family-only zoning, while Lansing legalized ADUs by right. These cities already align with MI Home criteria and are poised to receive early program benefits.

3. Oakland County Opportunities

Cities like Farmington Hills, Novi, Troy, and West Bloomfield could see new townhomes, duplexes, and “missing middle housing” options. These Oakland County affordable homes would directly benefit first-time homebuyers in Michigan and downsizers alike.

Who Stands to Gain?

- Homebuyers & Renters: Expanded inventory means relief from bidding wars and skyrocketing rents.

- Communities: Infill development in Detroit’s North End or Pontiac strengthens neighborhoods and revitalizes local businesses.

- Builders & Realtors: Grants and loans reduce barriers for developers, while Realtors gain valuable new inventory for clients.

- Employers: Hospitals, schools, and automakers can partner with the state to support workforce housing initiatives.

“Housing is economic development,” explains James O’Connor, CEO of the Detroit Regional Chamber. “If workers can’t afford to live where they work, businesses suffer too. The MI Home Program aligns housing with Michigan’s economic growth goals.”

Challenges Ahead

Despite its promise, the MI Home Program faces hurdles:

- Legislative Approval: Funding depends on bipartisan support in Lansing.

- Administration: MSHDA must scale up to manage housing grants, loans, and compliance oversight.

- Local Zoning Delays: Cities that stall on zoning reform could miss out on funding opportunities.

Oakland County Housing Market Snapshot (2025)

Here’s a look at today’s local housing conditions:

- Farmington Hills: Avg. home price $375,000; supply under 2 months.

- Novi: Avg. home price $450,000+; high demand for condos and townhomes.

- Northville: Luxury homes dominate, but missing middle housing is scarce.

- West Bloomfield: Lakefront properties thrive, while affordable options remain limited.

Mortgage rates hovering between 6–7% make affordability tougher. Programs like MI Home could be the difference between perpetual renting and achieving homeownership.

What Success Could Look Like by 2030

If implemented successfully, Michigan could achieve:

- 10,000+ affordable homes created or rehabilitated statewide.

- Revitalized neighborhoods in Detroit, Pontiac, and Southfield.

- More balanced supply and demand, stabilizing housing prices and rents.

- Improved workforce retention as employers invest in housing access.

How Residents Can Get Involved

- Stay Informed: Monitor local zoning meetings in Farmington Hills, Novi, and Troy.

- Advocate Locally: Support policies that legalize ADUs, duplexes, and mixed-use housing.

- Partner With Experts: Work with an Oakland County Realtor who understands how policy changes affect the housing market.

Conclusion: A Blueprint for Hope

The MI Home Program is not a silver bullet, but it’s a bold step toward addressing Michigan’s housing shortage. For Oakland County and Metro Detroit, it offers a pathway to stabilize housing, expand affordable home options, and strengthen communities for decades to come.

📞 Contact Tom Gilliam – RE/MAX Classic at 248-790-5594 or visit Homes2MoveYou.com to learn how these housing initiatives could impact your buying or selling decisions in Oakland County.

Recommended Reading

- Why Farmington Hills is Still a Hot Market: 2025 Price Trends & Buyer Insights

- Top-Rated School Districts in Oakland County, MI — and How They Impact Home Values

- Preparing for a Home Inspection in Oakland County, Michigan