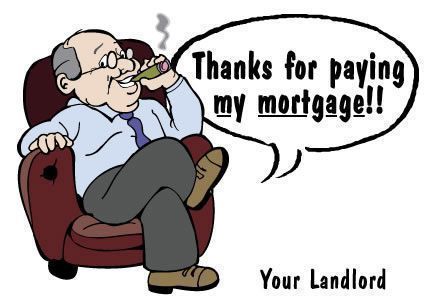

Put Your Rent Check to Work:-The only one who benefits from a rent check is the landlord. Renters never see that money again, while homeowners usually profit when they sell. In addition, renters can’t use any of their rent payment as a tax deduction, like homeowners can. If you or someone you know is renting, it’s time to put that rent check to better use!

The mortgage-interest deduction is probably the best financial argument for buying rather than renting. Consider this example:

If you can afford a mortgage payment of $1,000 (principal and interest only), you can buy a house for $151,426 if you put 10% down on a 30-year mortgage at 8% interest. If your payments started in January, you would pay $10,862 in interest for the first year in the home. That entire amount is deductible on your federal income tax return! Assuming you are in the 27.5% tax bracket, you would save $2,989 in taxes, or $249 per month. So your $1,000 payment is really only $751 when you factor in the homeowner’s tax advantage.

Can A Renter Really Afford To Buy?

The real question is whether renters can afford not to buy. The tax savings alone make the purchase of a home a wise financial decision. But let’s go a step further.

Using the same example, a 10% down payment would create an immediate equity of $15,142. Assuming the $151,426 house grows in value by just 3% a year, in five years it would be worth $175,544. The original loan amount would then be down to $129,565, yielding an equity of $45,980. In addition, remember the nearly $3,000 tax savings every year. The total value of your equity and tax savings would be almost $61,000 after five years.

Pick A Loan

To take advantage of the financial benefits of homeownership, renters must first find out how much buying power they have. We can help. Call us for information about the whole range of mortgage options now available, including low- and no-down-payment loans, and programs that allow buyers wrap home-improvement costs and closing costs into the mortgage.

Plan Ahead

Although some lenders allow buyers to use up to 41% of monthly income to purchase a house, beware of becoming “house rich and cash poor.” Be sure to budget for homeownership costs beyond the mortgage, including expenses for:

moving

decorating and furnishing

homeowners insurance

property taxes

homeowners association fees (if any)

utilities-power, water, sewer, cable, trash pick-up

yard tools, supplies and general upkeep

home repairs, supplies, cleaning and upgrades.

Today, home ownership is a wonderful dream-come-true for more people than ever before. Let me help turn those dreams into a home to be proud of.